Prepare the Adjusting Entries Based on the Reconciliation

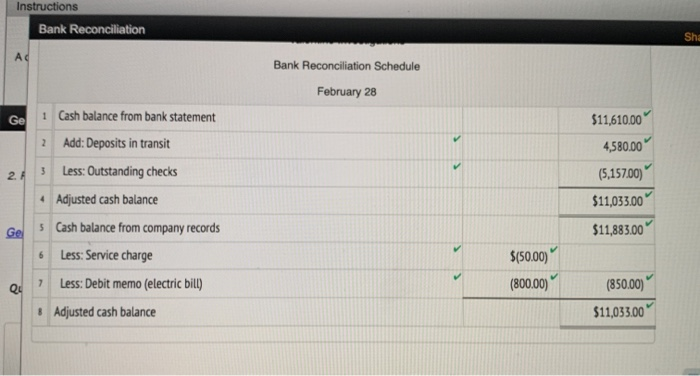

Prepare the adjusting entries based on the reconciliation. The adjusted cash balance per bank agreed with the cash balance per books at November 30.

Solved B Prepare The Adjusting Entries Based On The Chegg Com

Prepare the adjusting entries based on the reconciliation.

. List all debit entries before credit entries. Transactions initiated by the bank. Journal entries are required in a bank reconciliation when there are adjustments to the balance per books.

Calculate your paper price. Post the adjusting entries to the ledger T-accounts. Journalize and post petty cash fund transactions.

Prepare the adjusting entries based on the reconciliation. The correction of any errors pertaining to recording checks should be made to Accounts Payable. The correction of any errors pertaining to recording checks should be made to Accounts Payable.

1 answer below The bank portion of. Outstanding checks1145NSF check plus processing fee 125 Bank service. B Prepare the adjusting entries based on the reconciliation.

The correction of any errors pertaining to recording. November 28th 2015 Bank reconciliation and the adjusting entries Financial Accounting Project II. Prepare the adjusting entries based on the reconciliation.

The correction of any errors relat- ing to recording cash receipts should be made to Accounts Receivable. Hence the easiest way of preparing the bank reconciliation is to consider the reasons for the differences and record the reconciliation items or adjust add the entry in the accounting record based on the types of difference. This can be proven by finding the balance in the Cash account from parts a and b Journalize the adjusting entries resulting from the bank reconciliation and adjustment data.

The four adjustments in bank reconciliation include. Prepare the adjusting entries based on the reconciliation. The correction of any errors pertaining to recording checks should be made to Accounts Payable.

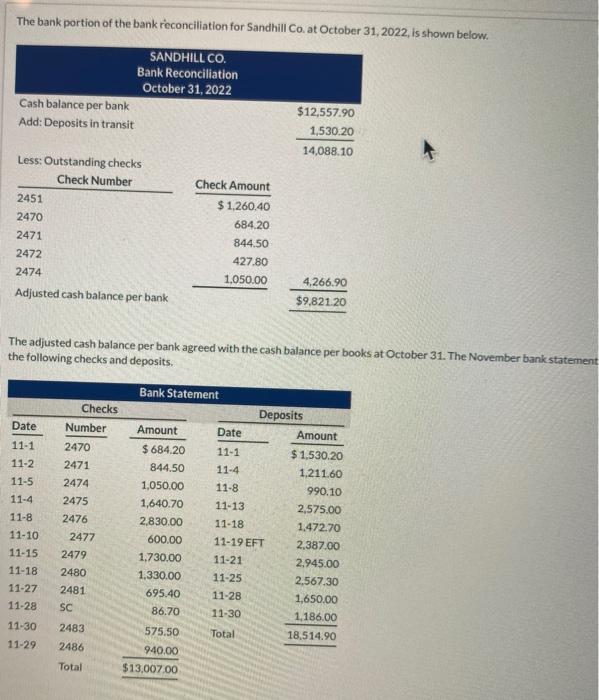

Prepare the bank reconciliation at September 30. Prepare the necessary adjusting journal entries based on the reconciliation reportUMBER COMPANYBank ReconciliationSeptember 30Bank statement balance1350Book balance of cash 995Add. A Using the reconciliation procedure described on pages 41415 prepare a bank reconciliation at 31 December.

The correction of any errors per- taining to recording checks should be made to Accounts Payable. Langer Company Bank Reconciliation Statement December 31 2019 b. Learn how to prepare a general ledger reconciliation in five steps.

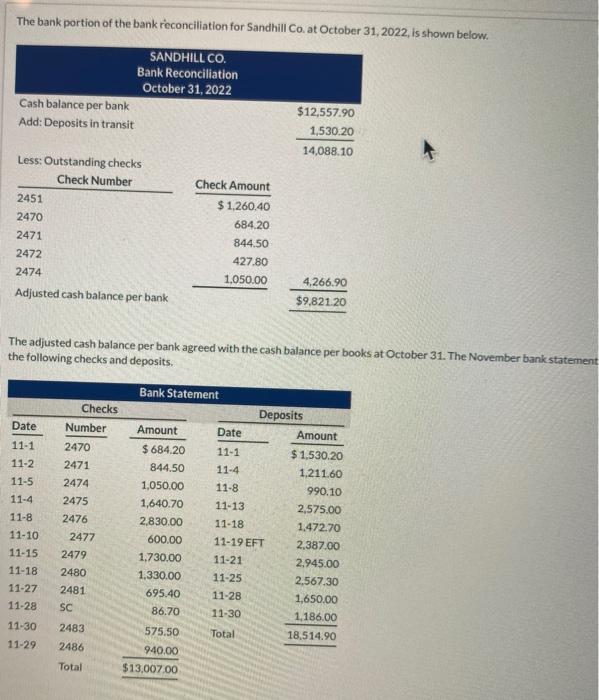

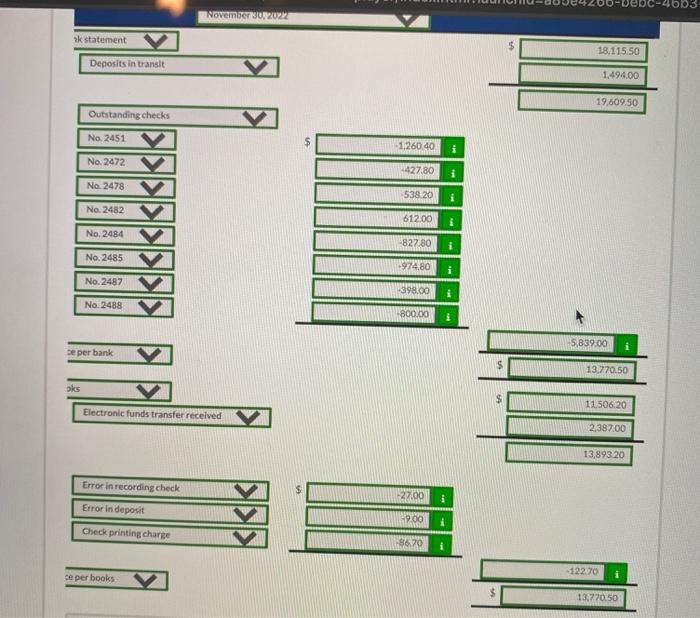

A Using the four steps in the reconciliation procedure described on pages 384385 prepare a bank reconciliation at November 30. Fraud Internal Control and Cash. A Using the reconciliation procedure described on pp.

The bank portion of the bank reconciliation for Carlin Company at November 30 2012 is shown here and on the next page. Prepare an adjusted trial balance. Definition of Journal Entries in a Bank Reconciliation.

Prepare a bank reconciliation and adjusting entries from detailed data. Prepare a multiple-step income statement for December and a classified balance sheet at December 31. B Prepare the adjusting entries based on the reconciliation.

LOUDA COMPANY Bank Reconciliation October 31 2007 Cash balance per bank 1236790 Add. 41415 prepare a bank reconciliation as at 30 November. QuickBooks Online is the browser-based version of the popular desktop accounting application.

Bank Reconciliation Novemeber 30 2006. Adjusted cash balance per books 000 b Prepare the adjusting entries based on the reconciliation. B Prepare the adjusting entries based on the reconciliation.

On July 31 the bank statement showed an NSF charge of 575 for a check received by the company from W. Balance per bank statement Add-Less. The December bank statement showed the following checks and deposits.

Prepare the bank reconciliation as of July 31. Prepare the necessary adjusting entries at July 31. Using the steps in the reconciliation procedure described in the chapter prepare a bank reconciliation at December 31 2020 b.

Krueger a customer on account. 13 rows prepare the adjusting entries based on the reconciliation 577530 March 20 2022 in by Carlos. The correction of any errors pertaining to recording cheques should be made to Accounts Payable.

The bank portion of the bank reconciliation for the Louda Company at October 31 2007 as as follows. Langer Company Adjusting Entries. Using the steps in the reconciliation procedure described in the chapter prepare a bank reconciliation at December 31.

These adjustments result from items appearing on the bank statement that have not been recorded in the companys general ledger accounts. What journal entries are prepared in a bank reconciliation. Deposits in transit 153020 1389810 Less.

- Adjusted cash balance per bank - Balance per books Add. Using the four steps in the reconciliation prepare a bank reconciliation at December 31. Deposit in transit1250Proceeds of note 875Bank error275 2875 1870Deduct.

List items that increase cash balance first 2Prepare the adjusting entries at September 30 assuming 1 the NSF check was from a customer on account and 2 no interest had been accrued on the note.

Solved Prepare Adjusting Entries For Valentine Based On The Chegg Com

Bank Reconciliations Journal Entries Youtube

Solved B Prepare The Adjusting Entries Based On The Chegg Com

Comments

Post a Comment